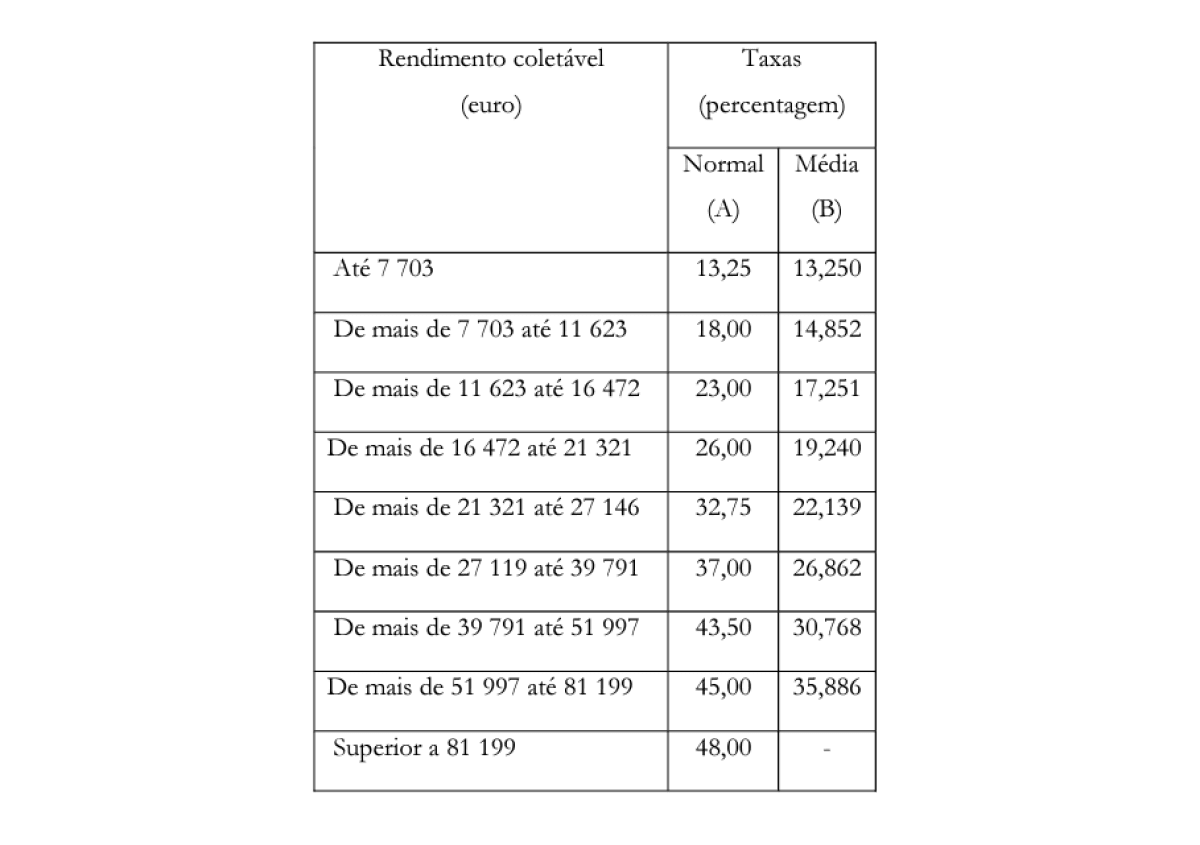

The new IRS schedule, which will apply to 2014 earnings, locks in a 3% update to income categories to match next year’s inflation forecast as estimated by the executive branch.

On the other hand, according to the 2024 State Budget (OE) proposal presented to Parliament on Tuesday, marginal tax rates will be reduced to class 5.

Given the tax model, the reduction will have an impact not only on taxpayers with income up to level 5, but also on others in the relevant income segments falling within that level, who will also see the reduction impact their average tax rates. .

The minimum wage increases to €11,480, reflecting an increase in the minimum wage to €820 as a result of an agreement with partners.

The OE 2024 proposal enshrines “important cuts to the IRS,” Fernando Medina stressed to reporters in parliament shortly after presenting next year’s budget proposal. “The main goal,” he stressed, is to “respond to the needs of Portuguese families” by “increasing income.”

It should be noted that last year there was an opportunity to update the tax bracket by 5.1% – the base value of the 2023 wage increase provided for in the revenue agreement. Under the OE proposal, for 2024 this rate was set at 5% included in the agreement signed with the social partners last weekend, up from the 3% at which levels are updated. This jeopardizes the goal of fiscal neutrality as the government acknowledges that wages will rise by at least 5%. The effect in practice will have to be assessed whether a rate cut can compensate for this.

(in update)

Author: Business magazine

Source: CM Jornal

I’m Tifany Hawkins, a professional journalist with years of experience in news reporting. I currently work for a prominent news website and write articles for 24NewsReporters as an author. My primary focus is on economy-related stories, though I am also experienced in several other areas of journalism.