In recent years, the most common solution is to obtain a loan from a bank to purchase a house. After all, buying a home with little savings and no down payment is a nearly impossible task. Thus, it is very important to find a bank with the best mortgage offer for your specific case, one that offers a realistic installment amount that you can pay off at the end of the month.

As a credit intermediary, Flipai – a registered trademark of Eupago (a payment institution controlled by Banco de Portugal, specialized in payment solutions, which works with the main banks in Portugal, acting as an intermediary between them and their clients), optimizes the negotiation process, handles all related issues . bureaucracy, supports the collection of necessary documentation and accompanies clients until the day of the transaction.

How to get a home loan: step by step

Don’t despair, there are five ways to buy a house without any money. Flipeye will teach you:

1. How much can you put down as a down payment?

First, Flipai needs to know how much it can pay up front. While there are situations in which you can obtain 100% financing for a home purchase (bank real estate or rental property), this is not the most common situation. In a regular home loan the bank lends from 85% to 90% of the value of the property. So the input value is the first factor to consider.

There are other costs associated with buying a home. There will be costs for opening the loan, fees for the notary or lawyer drawing up the deed, stamp duty and property transfer tax (IMT). Flipai recommends having 15% to 20% of the total property value available.

2. What will be the amount of contribution that will be paid to the bank?

The amount you can request from the bank depends on the level of effort. In other words, it is necessary to determine what part of the family’s income will be used to repay the loan.

In case of home loan house payment cannot exceed 35% of monthly income household.

3. How long can you pay in installments?

You may not know, but Banco de Portugal recommends certain restrictions on the duration of mortgage loan agreements. Hence, loan term depends on age the oldest owner. Up to and including 30 years, the maximum mortgage term is 40 years. For owners aged 30 to 35, the maximum mortgage term is 37 years. For holders over 35 years of age, the maximum mortgage term is 35 years. It is with these deadlines that you can “play” in order to distribute productivity over time and not exceed the standard of effort.

To make the process of applying for a new loan as simple and convenient as possible, Flipai offers several 100% digital tools that will be very useful over time:

• Flipai platform with real-time alerts;

• Integration of electronic documents;

• Virtual assistance when choosing a new loan.

4. Talk to Flipeye and find your bank.

Let’s sum it up! Your savings correspond to 15% or 20% of the total cost of the home, so your budget is set. You also know what the maximum payment you can pay to the bank (35% of your total income) and what the maximum term of your loan is (depending on your age). All you need to do is find the bank that offers the best terms for your mortgage.

But it is at this stage that many families have doubts about whether to read the “fine print” and understand which offer is the most profitable. That’s why Flipai exists. Fill out the form with your details and a team of experts will analyze your case, compare the best options on the market and help you choose the bank that suits your needs.

5. Run a loan simulation now.

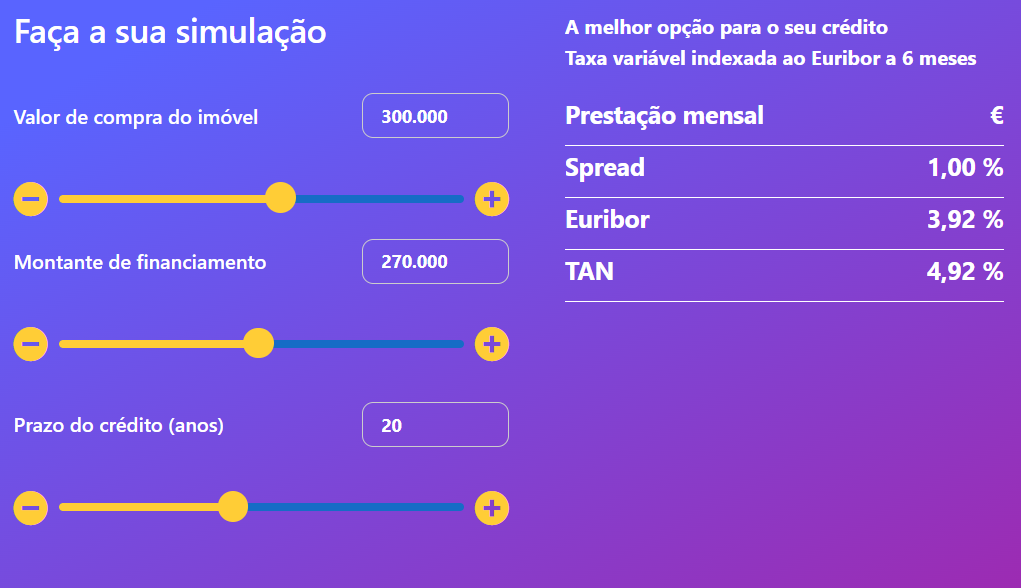

“How much money can I borrow from the bank?”, “What will the monthly payment be?” – these are some of the most frequently asked questions. Flipai’s home loan simulator answers these questions and more. Simply answer three questions – your name and contact details, the amount you need to borrow from the bank, and the purpose of the mortgage loan (purchase of a house, construction, transfer of credit or credit for other purposes, such as construction) – for a specialist to contact you and start working on the case.

Why trust Flipai to take out a mortgage?

– The brand handles hundreds of cases like yours and has close relationships with banks. That’s why, you get better conditions than if you contact each bank directly.

– You don’t have to go to multiple banks because Flipai will do this analysis for you and compare the best options. So, simplifies the entire process of applying for a home loan to buy a home.

– Clarify all your doubts regarding loan terms and various interest rates. A The Flipai team can help you choose the best option for your family in the long run..

Why are Flipai services free for you?

Flipai’s services are completely free. How? The company’s remuneration is made by banking institutions with which it has partnerships. And don’t worry, this partnership won’t affect the terms of your mortgage. Flipai has agreements with many banks, and they all pay a commission. So, the focus is really (and only) on finding a home loan with the best terms for you.

I already have a loan, can I transfer my mortgage?

Inflation is rising, whether it’s in supermarkets, fuel or housing costs. Therefore, transferring your mortgage to another bank may be the best solution to save money and avoid high payments. Flipai’s team of professionals will help you with transfer of your home loan through personalized credit simulations. After answering your questions, the company’s consultants will contact you, exploring alternatives on the market until you find the best service.

Whoever wants a house buys a house!

Completely free and fast, Flipai is a brand with a revolutionary service that simplifies the process of getting a mortgage. Besides helping clients at such an important stage of their lives with all the paperwork and bureaucracy, he guides them step by step until the day of the transaction.

What do you tell us? Change your life and start a new chapter. Do this and step into your new home on the right foot!

Source: CM Jornal

I’m Sandra Hansen, a news website Author and Reporter for 24 News Reporters. I have over 7 years of experience in the journalism field, with an extensive background in politics and political science. My passion is to tell stories that are important to people around the globe and to engage readers with compelling content.