The Bank of England raised interest rates for the tenth time in a row, writes The Guardian on February 2.

The increase was 0.5 percentage points. It should be noted that the majority of the members of the bank’s monetary policy committee said that the rate hike is necessary after a jump in private sector wages to contain inflation. At the same time, two of the nine members of the commission voted to keep the rate at 3.5%, arguing that the previous increase had not had time to take effect.

The Bank has forecast that the UK economy will enter a recession, but it will not be as deep or prolonged as previously forecast. Production will drop just 1%, not 3% as previously predicted. The recovery should start after the first quarter of 2024, until then the economy will contract.

According to the forecast of the experts, in the spring the Bank of England will raise the rate to 4.5%.

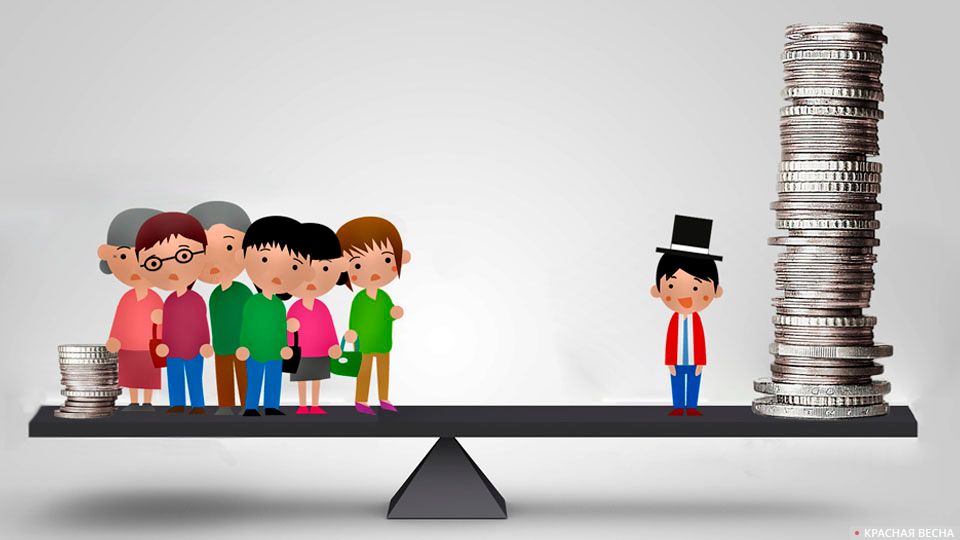

It is warned that as a result of rising interest rates, citizens refinancing home loans and hundreds of thousands of families refinancing their loans at higher rates in 2022 will suffer first.

Remember, the European Central Bank is also expected to raise interest rates.

Source: Rossa Primavera

I am Michael Melvin, an experienced news writer with a passion for uncovering stories and bringing them to the public. I have been working in the news industry for over five years now, and my work has been published on multiple websites. As an author at 24 News Reporters, I cover world section of current events stories that are both informative and captivating to read.