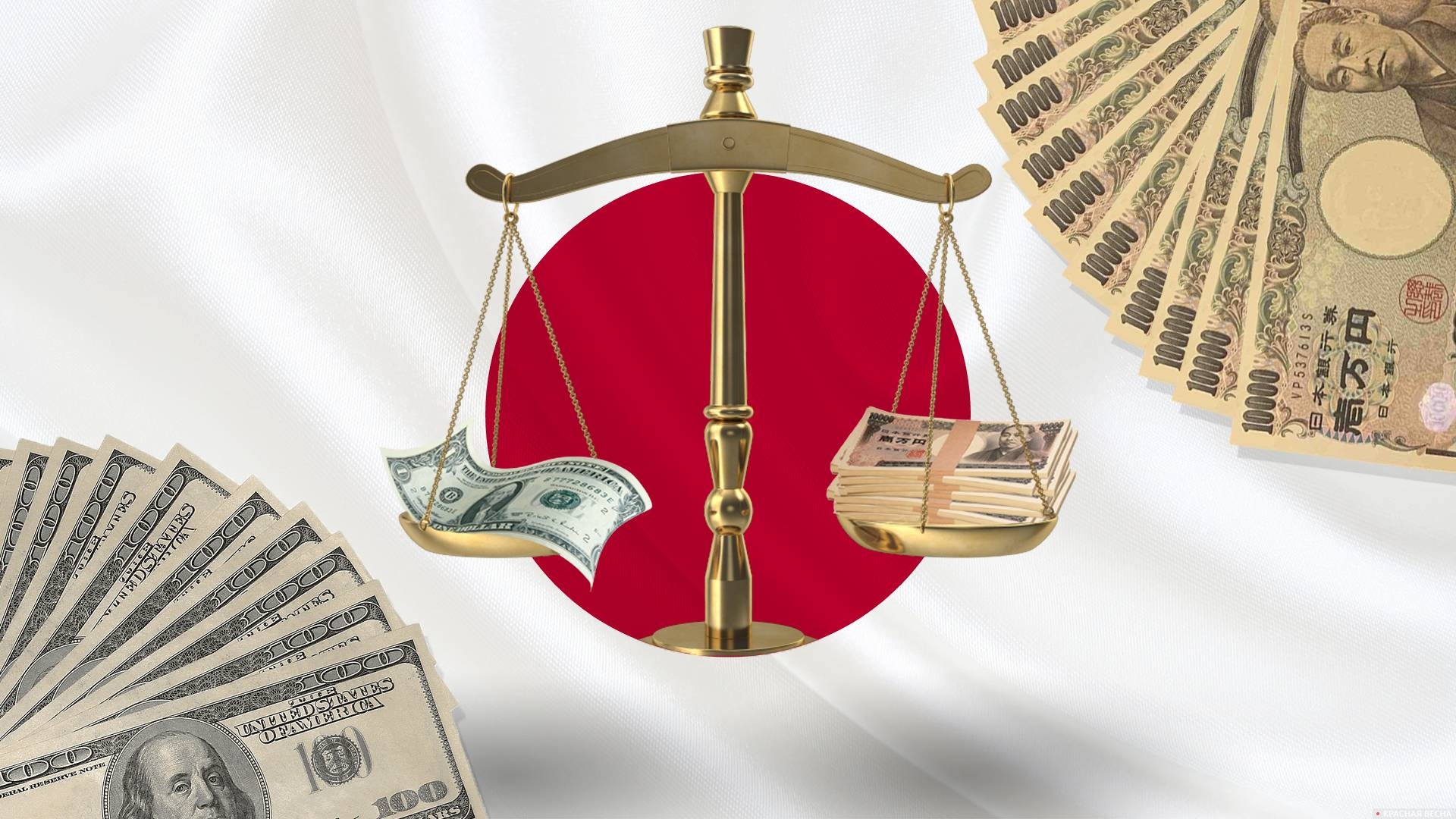

The US dollar rose to a new 34-year high in Tokyo on Thursday in the upper 155 yen range, business agency Kyodo News reported on April 25.

Analysts explain the yen’s decline by saying that “currency traders were testing the limits of the yen’s weakness amid speculation that market intervention by Japanese authorities was still a long way off.”

Recent better-than-expected U.S. economic data has reduced traders’ bets that the Federal Reserve will soon cut interest rates, suggesting a continuation of the wide interest rate differential between Japan and the United States that has caused the yen to fall to approximately 155.73 yen.

At 3 pm, the dollar was trading at 155.65-68 yen, compared with 155.28-38 yen in New York and 154.89-91 yen in Tokyo at 5 pm on Wednesday.

The euro was trading at $1.0711-0715 and 166.72-81 yen against 1.0693-0703 and 166.13-23 yen in New York and at $1.0687-0689 and 165.54-58 yen in Tokyo late Wednesday.

The US currency crossed the psychologically significant range of 155 yen on Wednesday afternoon after the Japanese markets closed. This level is widely seen as a red line for possible intervention by Japanese authorities to curb the yen’s weakness.

But while Finance Minister Shunichi Suzuki has issued several verbal warnings in recent days about monetary volatility, his comment on Thursday that there was “no change” to the government’s position on how to respond to market changes left actors with the feeling that the intervention can leave a certain margin of safety, market observers noted.

“Since there was no intervention yesterday and the Bank of Japan’s two-day policy meeting will end tomorrow, the market is inclined to believe that intervention will not happen today,” said Takuya Kanda, senior researcher at research institute Gaitame.com.

“The dollar is likely to approach the 156 yen mark as traders look to test where the limits are,” he added.

Source: Rossa Primavera

I am Michael Melvin, an experienced news writer with a passion for uncovering stories and bringing them to the public. I have been working in the news industry for over five years now, and my work has been published on multiple websites. As an author at 24 News Reporters, I cover world section of current events stories that are both informative and captivating to read.