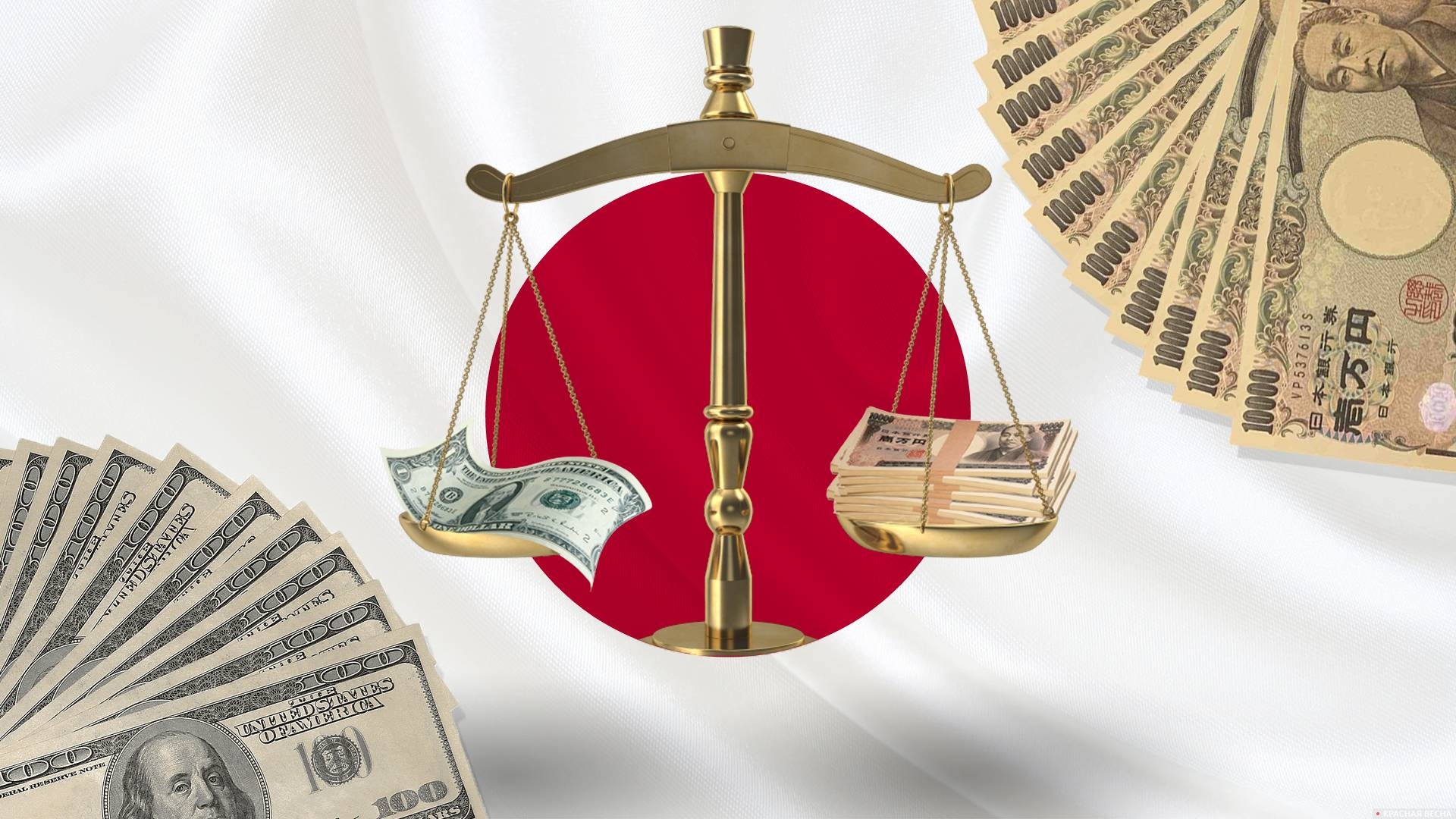

The yen fell to a new 34-year low against the dollar after the Bank of Japan said its monetary policy would remain accommodative, The Japan Times reported on April 27.

The Japanese currency weakened 1.4% on the day and hit a session low of 157.79 yen per dollar in afternoon trading in New York. The cut followed a Bank of Japan meeting in which the central bank left its key interest rate unchanged and Governor Kazuo Ueda said little to support the currency during a news conference.

Losses widened even as U.S. core inflation was in line with expectations, easing concerns about persistent price pressures that could delay rate cuts by the Federal Reserve.

The yen has already lost more than 10% of its value against the US dollar this year, the worst performance among Group of 10 currencies. Driving the depreciation is the huge gap between US interest rates (which are at its highest level in decades after aggressive monetary policy). (the Federal Reserve’s rate tightening cycle last year) and interest rates in Japan, where borrowing costs remain stubbornly low, close to zero.

“It’s an incredible weakness,” said Justin Onuekwusi, chief investment officer at St James Place Management. “Of course, this level of weakness will be a cause for concern. “We believe the yen has gone too far and our outlook is to take advantage of it.”

Politicians have repeatedly warned that a devaluation cannot be tolerated if it goes too far and too fast. Finance Minister Shunichi Suzuki confirmed after the Bank of Japan meeting that the government will respond accordingly to changes in exchange rates.

The Topix stock index rose 0.9% following the Bank of Japan’s decision, and real estate companies extended their gains. The yield on the benchmark 10-year bond fell to 0.925% from 0.93% the previous day.

“Once again, the Bank of Japan has shown that it can surprise even the most moderate expectations on Wall Street,” said Charu Chanana, strategist at Saxo Capital Markets. “We are again waiting for intervention to stop the debacle at the Bank of Japan. yen But any intervention, unless coordinated and supported by tough policies, will remain useless.”

In a trilateral statement last week, the United States, Japan and South Korea said they would continue to consult closely on developments in the currency market, while acknowledging Japan and South Korea’s serious concerns over the recent sharp depreciation of their coins.

According to an analysis of comments by Masato Kanda, head of foreign exchange at the Ministry of Finance, 157.60 yen against the dollar is one of the key levels to watch. The ministry will release intervention data for the period March 28 to April 25 on Tuesday, while data including Friday will be released on May 31.

Other possible triggers include holidays in Japan on Monday and Friday next week, which pose a risk of volatility amid weak trading.

“If the yen falls further, as it did after the Bank of Japan’s decision in September 2022, the likelihood of intervention will increase,” said Hirofumi Suzuki, chief currency strategist at Sumitomo Mitsui Banking. “It’s not about the level, but about the speed that will trigger the action.”

Japan made its first yen buying intervention since 1998 in September 2022, when then-bank governor Haruhiko Kuroda made soft comments following the policy decision and the currency fell. Japan entered the market three times before October of that year, spending more than 9 trillion yen (5.3 trillion rubles).

Source: Rossa Primavera

I am Michael Melvin, an experienced news writer with a passion for uncovering stories and bringing them to the public. I have been working in the news industry for over five years now, and my work has been published on multiple websites. As an author at 24 News Reporters, I cover world section of current events stories that are both informative and captivating to read.